GST E Invoicing + E way Bill Built into Microsoft Dynamics NAV / BC

How E invoicing effects you

Tax compliance remains top of mind issue of CXO’s

Current business scenario

- Organization has B2B Invoicing

- Has volume Invoicing not feasible to use offline mechanism

- Mandatory from 1st Oct 2020 500 crore and above

- Mandatory from 1st Jan 2021 100 crore and above

- Using Microsoft Dynamics NAV 2016 IN / BC for accounting Sales transactions

Write to [email protected] and get Started with Demo!

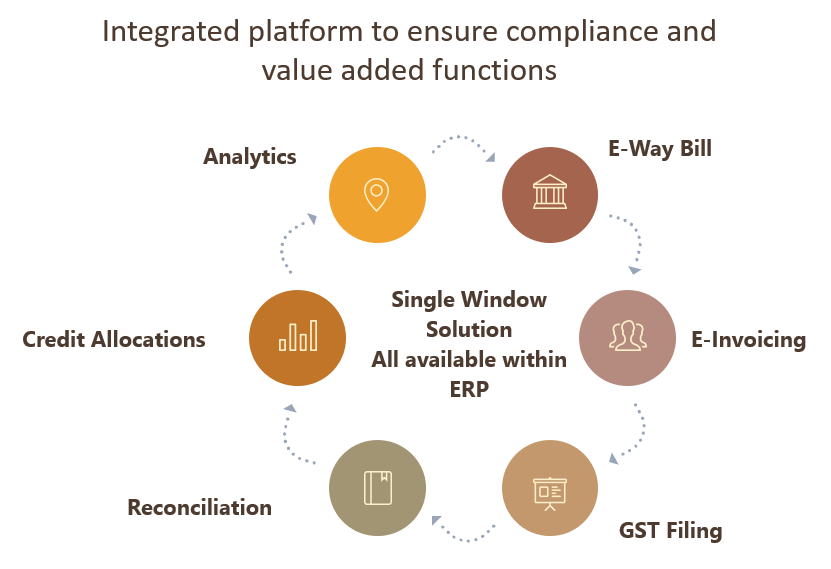

Features of autoTax 365

GST Filing and Reconciliation out of ERP NAV 2016/ BC

- Realtime integration while document posting

- E Invoice generation for all applicable documents e g Sales Invoice, debit note, Credit memo and transfers for B 2 B, B 2 G, Export

- As soon as the Sales invoice is posted, a request is automatically sent, as JASON, from NAV to IRP for IRN and QR code generation

- On a Successful Response, a message will be generated and the IRN and QR code information shall get captured along with the posted documents and can be printed in the document like Invoice, Credit Memo

- In case of a failure or response, the error message shall be displayed and the user can retry from the posted Document

- System maintains a error log along with complete Audit Trail of all the requests and response for E Invoice generation

- Solution is developed with collaboration with Masters India

Scope of Deliverables

- IRP / GSP integration (API Integration with JSON file)

- Update IRN number and QR code string in Dynamic NAV through integration

- Decode QR code string (Provided by IRP) to print QR code on the invoice along with IRN number

- Changes in Invoice format to print QC code and IRN number (Total 3 document reports will be in scope)

- Validation prior posting for mandatory e invoice information

List of activities to be carried out in the implementation

- Client to share administrative access to their development environment for deployment of the extension

- Configure standard autoTax 365 setup information for E invoicing

- Train the user with the key functionalities of generating E invoice

- Share a list of information required to generate a successful E invoice mandatory fields

- Information about HSN/SAC code Pin Codes UOM and other details